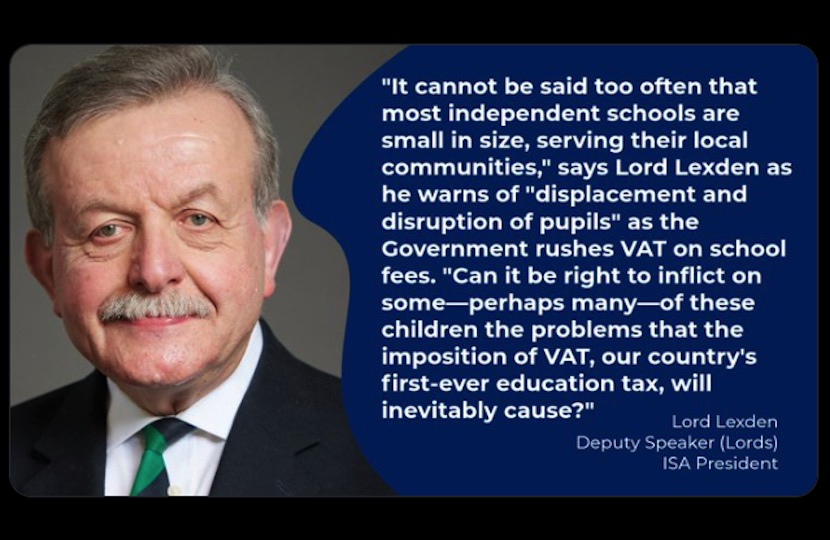

On 29 January, the Lords debated a Government Bill which will remove the rates relief that independent schools with charitable status have always enjoyed. Alistair Lexden’s speech in the debate follows.

I declare my interest as a former General Secretary of the Independent Schools Council and the current President of the Independent Schools Association, one of the Council’s constituent bodies, which has just under 700 member schools, most of them small in size and operating on tight budgets without any reserves whatsoever, dependent on fee income which in some cases can be as low as £3,000 per pupil a year.

The Council - the chief representative of the independent education sector - acts on behalf of some 1,400 schools altogether, immensely diverse in character, which are educating with marked success around 80 per cent of the 600,000 children in the independent sector.

No responsible Government would seek to make life difficult for these flourishing schools, some of world renown. Yet severe difficulty is exactly what this Government is creating for them.

This Bill continues and extends the Government’s attack on independent schools - an attack which recognises no distinction between the very varied types of school to be found within the independent sector of education.

The Government treat them as if they were all the same, all equally capable of shouldering the new financial burdens, each one of them unprecedented in character, which they are inflicting on independent schools in quick succession.

Perhaps the Government believe that all independent schools can somehow find the means to pay their unprecedented financial exactions. If they believe that, they are putting hostile prejudice before reality.

Over 1,000 independent schools, 40 per cent of the total in England , have fewer than 100 pupils, according to the Education Department’s figures. Is it not obvious that these numerous small schools will suffer particular hardship as a result of the unprecedented financial pressures that the Government are piling on them?

Some will go under. Evidence is accumulating, and the Independent Schools Council will ensure that all of it is all placed prominently before the public.

This will add to what is already known. A revealing short debate on Monday this week, introduced by the noble Lord, Lord Morrow, brought to our attention the sharp fall - of no less than one third - in the number of prep schools in Northern Ireland after Sinn Fein made them pay VAT.

It is well known, I think, that Northern Ireland has some of the best schools in the country, achieving spectacular exam results. It is deplorable that their number should have been reduced by a VAT burden.

On 1 January, just four weeks ago, the Government slapped VAT at 20 per cent on all independent schools, having given them no more than a few months to rework the budgets they had already drawn up for the current school year. It was a terrible thing to do.

As they endeavour to come to terms with Labour’s new education tax, independent schools must now prepare for two more financial burdens: the increase in national insurance contributions and the full payment of business rates - for the first time ever - under the terms of the Bill before us today.

So independent schools face a threefold assault from this Labour Government—an assault carried out in just six months.

The Government rejoice that through this Bill they will end “tax breaks.” What do they mean by this? Presumably, they want us to think that they are taking away from independent schools exemption from taxes that they did not deserve in the first place, but had somehow managed to acquire.

That is absurd. There are no special arrangements which have hitherto enabled independent schools to get out of paying taxes. They have shared with all other providers of education services exemption from VAT. Those schools that are charities have until now shared in the tax arrangements that cover the charitable sector as a whole.

This Bill will create a two-tier charity system in our country, with independent schools in the bottom tier, where other charities may well join them in due course as the Government finds fresh targets to hit.

This Bill will establish for the first time that charities which the Government does not like can be stripped of their charitable treatment, even while they comply with their obligations and serve the community at large through work of great public benefit.

For independent schools, public benefit work increasingly takes the form of partnership with state school colleagues. Up and down our land the two education sectors are working together in thousands of partnership schemes. The increased costs that the Government are inflicting on independent schools will endanger this invaluable work.

Remarkably, the Bill will inflict grave damage on independent schools without raising significant revenue. The Budget documents estimate that some £ 70 million will be raised in 2025-26 - just 0.1 percent of the core schools budget. Could there be any clearer evidence of this Government’s hostility to independent schools?

Is this, by the way, the first legislation to substitute private, for independent, schools in its wording ? Over the last thirty years or so the habit has grown up of referring to independent schools as private schools. It is an informal, everyday term.

Independent is the correct formal term. Why are the Government now abandoning it? The Education Department has always registered schools outside the state sector as independent schools. The Department has an independent schools division. Should not legislation respect formal, correct usage?

It will be evident that my chief concern is the damage that this Bill will do to the small schools, which abound in the independent education sector, as a result of the threefold financial assault that is being made on them at such speed.

I think of the 20,000 children who attend independent Muslim faith schools, charging pupils an average £3,000 a year.

I think of the 20,000 children at the UK’s 80 independent Jewish schools. Their representives said last month that they “cannot absorb the cumulative financial pressures”, adding that “it is likely we will see a significant proportion [of children] being left without a school to attend. Many will be left with no alternative but to be educated at home.”

I think of the many wonderful schools making superb provision for children with both complex and more moderate special needs at a time when the state SEND system is in such deep trouble. About 100,000 families will have to pay more as a result of the Government’s tax increases. A number will be driven into the broken—the Government admit that it is broken-- state SEND system, unless the tax rises are eased.

There will be much to consider in detail as we move to the Committee stage of this unfortunate Bill.